Why is this a good sign?

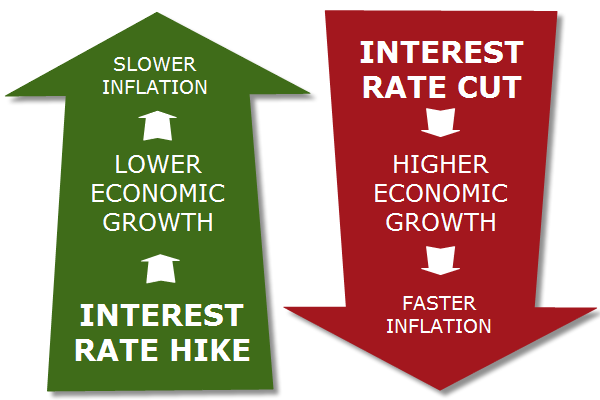

Interest rates rising 0.25% is not a sign of a looming doomsday, it is actually a great sign that our economy is healthy! Yes, it may mean a reduction in the amounts borrowed for many but a rise in interest rates actually helps to curb inflation rates which will keep the economy stable. The Fed has kept the interest rate at historic lows to help continue the growth of our economy from the previous recession but now that we are on a stable growth rate it is time to slowly raise rates to balance it all out.

Interest rates rising 0.25% is not a sign of a looming doomsday, it is actually a great sign that our economy is healthy! Yes, it may mean a reduction in the amounts borrowed for many but a rise in interest rates actually helps to curb inflation rates which will keep the economy stable. The Fed has kept the interest rate at historic lows to help continue the growth of our economy from the previous recession but now that we are on a stable growth rate it is time to slowly raise rates to balance it all out.

There are surprisingly several other benefits, however, that may affect you more personally when interest rates rise. Here are a few examples that could occur when interest rates rise:

- Higher yields on interest bearing accounts.

- Reduced inflation rate can make imported consumer goods cost less.

- Banks are willing to lend more.

- A stronger U.S. Dollar

Yes, the Federal Reserve has determined it will increase rates very slowly, possibly a few more times in the coming year but what does this mean to you? Interest rates are still at historic lows and we expect they will stay relatively low in the coming years. However, small increases in rates still cost more over the life of a loan for a home than a lower rate.